Why We Are Not headed For A Housing Crash

If you’re hoping that the housing market will crash and make homes more affordable, the data suggests it’s unlikely. In fact, experts predict that home prices will continue to rise.

The current housing market is not the same as it was before the 2008 crash, and here’s why.

Getting a home loan is more challenging now, but it’s a positive change. Before 2008, it was much easier to secure a home loan or refinance one because banks had lenient lending standards. Almost anyone could qualify.

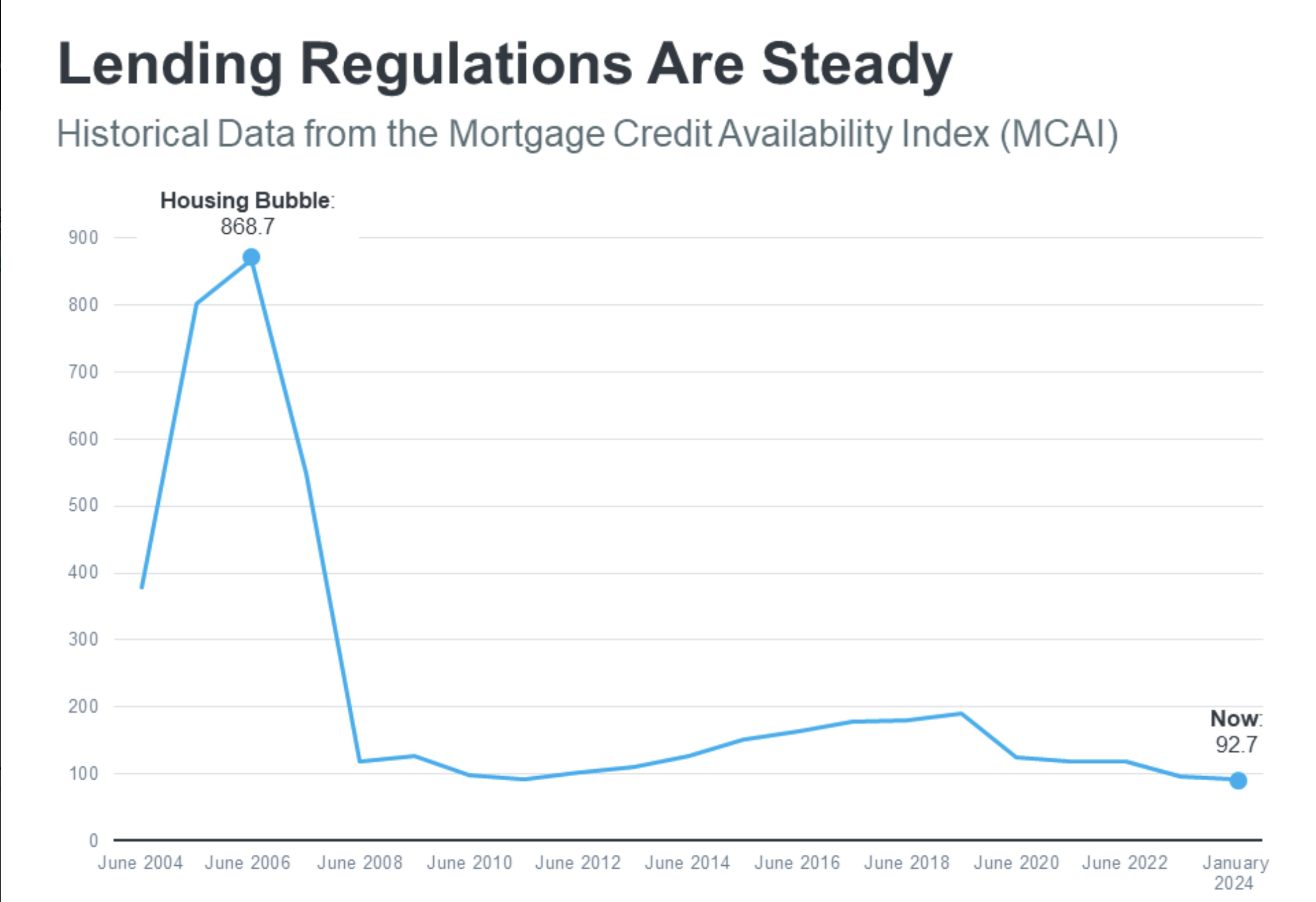

Today, the situation is different. Mortgage companies have raised their standards, making it more difficult for homebuyers to get loans. The graph below, based on data from the Mortgage Bankers Association (MBA), illustrates this change. A lower number on the graph indicates it’s harder to get a mortgage, while a higher number suggests it’s easier.

The highest point on the graph indicates that in the past, the rules for getting a loan were not as strict as they are today. This means that back then, lending institutions were willing to take more significant risks, both with the people they lent money to and the types of mortgages they offered. Unfortunately, this approach resulted in a large number of people defaulting on their loans and a flood of foreclosed homes entering the market.

Today, the situation is different because there are far fewer homes available for sale. Unlike during the housing crisis when there was an excess of homes, many of which were short sales and foreclosures, the current housing market faces a shortage of available homes. This scarcity is a key reason why home prices are not expected to experience a dramatic drop. The graph below, using data from the National Association of Realtors (NAR) and the Federal Reserve, illustrates the comparison between the current supply of homes (shown in blue) and the situation during the housing crisis (shown in red).

There’s only a 3.0-month supply of unsold inventory, a significant contrast to the 10.4-month supply peak in 2008. This scarcity in available homes suggests that there isn’t enough inventory for a drastic drop in home prices, as was seen in the past.

A key difference from the early 2000s is that people are now more prudent about using their homes as financial resources. Before the housing crash, many homeowners borrowed against their home equity to fund expenses like cars, boats and vacations. As home prices fell and inventory surged, these homeowners found themselves owing more than their homes were worth.

In today’s market, homeowners are exercising more caution. Despite the substantial increase in home prices in recent years, homeowners are not tapping into their home equity as freely as they did in the past. According to Black Knight, the amount of tappable equity (the equity available for homeowners before reaching an 80% loan-to-value, or LTV) has reached an all-time high.

This means that homeowners collectively have more available equity than ever before, which is a positive development. Compared to the early 2000s, homeowners are in a much stronger financial position. According to a repost from Black Knight:

“Only 1.1% of mortgage holders (528k) ended the year underwater, down from 1.5% (807k) at this time last year.”

With homeowners in a more stable financial position today, they have options to avoid foreclosure. This, in turn, reduces the number of distressed properties entering the market. With a limited influx of inventory, home prices are not expected to experience a significant decline.

In summary, despite the home for a decrease in prices, the data indicated otherwise. The latest research makes it clear that the current housing market is fundamentally different from the past, providing homeowners with more stability.